Introduction

You've been looking for the right AI tool to help with your accounting work. But searching online leaves you confused. Do these tools really do what you need? Can they work with your current software? Are they secure?

You just want accounting help, not more headaches. We get it!

So, we created a list of the best AI tools for accountants, so you can choose the right tool for your needs.

AI tools for Accountants Takeaways:

- The blog post discusses the different types of AI tools for accountants and their benefits.

- The top 12 best accounting software with AI include Scribe, Vic.ai, Indy, Docyt, Blue Dot, Truewind.ai, Appzen, DataSnipper, BotKeeper, SMACC, MindBridge AI Auditor, and AutoEntry.

- The post also offers tips on training employees to use AI tools effectively and answers frequently asked questions about AI in accounting.

- It highlights the future of AI in accounting, including automation of repetitive tasks, enhanced data analytics, and improved auditing processes.

Types of AI Tools for Accountants

1. Invoice Processing and Data Entry Automation:

Automate data extraction from invoices and receipts, and reduce manual data entry errors through OCR technology.

2. Expense Management and Reporting:

Streamline the tracking, categorization and reporting of expenses, ensuring compliance and providing spending insights.

3. Financial Forecasting and Predictive Analytics:

Use advanced algorithms to analyze financial data, aiding in strategic decision-making and financial planning.

4. Fraud Detection and Risk Management:

Analyze transaction patterns to detect fraud and assess financial risks, safeguarding assets and ensuring transaction integrity.

5. Tax Preparation and Compliance:

Ensure tax compliance, tax filing assistance, and identify opportunities for tax savings.

6. Accounts Payable and Receivable Automation:

Automate accounts payable and receivable processes, accelerating payment cycles and improving vendor and customer relationships.

7. Contract Review and Analysis:

Use natural language processing (NLP) to review and analyze contracts, extract key information, and ensure compliance with contractual obligations.

8. Benchmarking and Performance Analysis:

Assist in comparing financial performance against industry benchmarks and formulating strategic initiatives.

9. Client Communication and Relationship Management:

Facilitate personalized communication, track client interactions, and identify opportunities for upselling and cross-selling.

10. Process Documentation:

Improve accuracy, efficiency, training, and accountability. A variety of accounting tasks and processes can benefit from process documentation, including accounts payable, accounts receivable, payroll, financial reporting, tax preparation and filing, and audit preparation.

Benefits of Using AI in Accounting

Artificial Intelligence is providing the accounting industry with powerful tools to enhance and streamline their work. Accountants can use AI technology to enhance productivity, and accuracy, and make better decisions.

- Automate high-volume, routine accounting activities like data entry and invoice processing faster and more accurately than humans.

- Perform in-depth analysis of massive datasets to uncover insights for improving cash flow, optimizing spending, and identifying tax savings.

- Generate real-time financial reports and metrics by continuously aggregating data from multiple systems, improving forecasting.

- Identify anomalous transactions and potential fraud using AI pattern recognition, enhancing compliance.

- Offer tailored budgeting, payment, and capital allocation recommendations based on comprehensive data history and predictive modeling for individualized support.

Top 12 AI Accounting Tools for 2025

Here’s a list of the top 12 AI tools for accountants to choose from:

1. Scribe

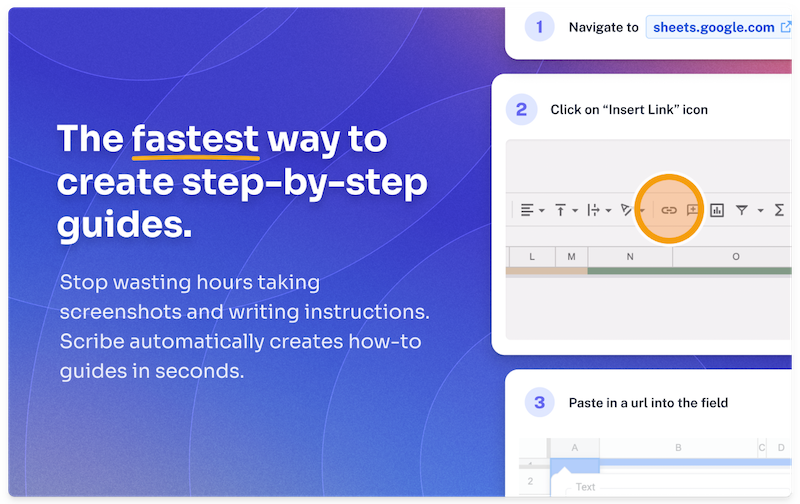

Creating accounting manuals is an important task for accounting firms but it also consumes a huge chunk of your time. That’s what Scribe solves for you.

Scribe is AI process documentation tool for any digital process. With the help of AI technology, it makes creating and managing accounting documents easy and quick, allowing your accounting team to make detailed and accurate documents without any hassle. This tool is a game-changer, making sure every task is done accurately and efficiently.

Take this Scribe on how to create a pivot table for example:

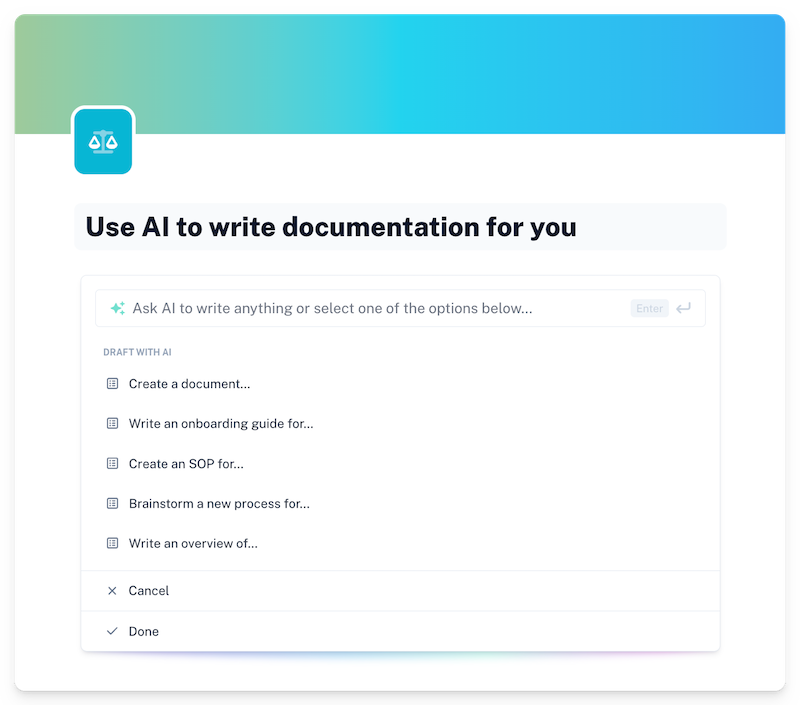

You can effortlessly automate creating accounting manuals, saving time and effort. You can use Scribe's generative AI to add titles, descriptions and additional context to your guides—or use it to create your documentation from scratch.

Scribe ensures that all your manuals are consistent and reliable by using standardized formats and reducing errors. All in all, Scribe is all about making your work smoother and more accurate.

Pros:

- Create and share engaging step-by-step accounting guides with one click.

- User-friendly drag-and-drop interface.

- Pre-built page templates.

- Use Scribe Pages to customize and edit your guides or combine them with videos, images, and other multimedia.

- Compatible with Windows, Mac and any browser.

- Real-time team collaboration features enable everyone to work together on the same manual and manage documents efficiently.

- Share guides instantly as a PDF document, embed in wikis and existing tools, or send directly with the URL link.

Here's how Scribe user Sarah DeAngelis at Ignite Spot Accounting uses Scribe to document their accounting processes:

Cons:

- Branding is only available for the Pro plan.

- Screenshot annotations and redactions are also only available for Pro subscribers.

2. Vic.ai

Vic.ai is tailored for accounting teams, aiming to minimize manual errors in one of the most critical processes—accounts payable. It offers real-time insights and AI data predictions, ensuring fewer errors and seamless integrations.

With Vic.ai you’ll spend 80% less time processing invoices. Plus, it’s not just about efficiency; it’s about strategic growth.

Pros:

- Automated invoice recording.

- Better control of cash.

- Supports high invoice volumes.

Cons:

- Users have reported that the system sometimes generates duplicate invoices.

- Lack of direct API integration.

- A learning curve for users.

3. Indy

Imagine managing your proposals, contracts, invoices, and more, all from one central hub. Indy is that all-in-one AI accounting tool for you. As an accountant, you can track billable hours, generate invoices, and ensure timely payments. The platform has a suite of nine essential tools, including a dedicated workspace for projects, a calendar for scheduling, and a time tracker to record and report your billable hours. Plus, with Indy's free plan, you get unlimited access to several tools and three free proposals, contracts and invoices each month.

Pros:

- Integrated online payment.

- You can organize projects and client information.

- It has a free plan available for you to test the product.

Cons:

- Potential overhead.

- Limited customization.

- Potential security concerns.

4. Docyt

Docyt takes the monotony out of repetitive bookkeeping tasks, letting you see your expenses and profitability in real time. Forget about manual data entry, its sophisticated automation provides instant visibility into your expenses, revenue, and profitability. But that's not all. With Docyt, multi-entity accounting becomes a breeze, offering both rollup and individual financial statements for all your business locations.

Pros:

- Easily automates repetitive tasks.

- Real-time insights on expenses, revenue and profitability.

Cons:

- Learning curve involved.

5. Blue Dot

With Blue Dot, you can effortlessly track, report and calculate taxable employee benefits concealed in expense reports, ensuring seamless compliance. The platform stands out with its prowess in VAT recovery, helping you align with global tax regulations and optimize VAT reclamation. Blue Dot's AI-driven application carefully analyzes these, ensuring accuracy and compliance.

Pros:

- Effortless VAT recovery.

- Automation of taxable employee benefits review.

- Integration with expense management platforms.

Cons:

- Potential learning curve.

6. Truewind.ai

Truewind replaces manual, error-prone accounting with automated accuracy. It uses advanced machine learning to seamlessly categorize transactions, reconcile accounts and generate real-time financial reports.

You also get high-level insights through customizable dashboards, cash flow forecasting, invoicing, budgeting tools, and more.

Pros:

- You can close your books in days instead of weeks.

- Has an excellent customer support.

Cons:

- No mention of security measures.

7. Appzen

Appzen is your go-to for automating spend approvals, ensuring compliance, and streamlining processes.

It’s an AI-powered Autonomous AP at your fingertips, accurately digitizing and validating every invoice and auditing for compliance. No more hassle of templates and OCR reviews!

Plus, it integrates seamlessly with various systems, showing ROI within days. For those handling T&E, AppZen customizes expense policies and identifies sneaky purchases, ensuring top-notch compliance and quicker reimbursements.

And, if you manage cards, experience real-time compliance with Card Audit, catching unauthorized spending swiftly.

Pros:

- Time efficient.

- Detects duplicate expenses.

Cons:

- Users have reported frequent integration issues.

- Limited functionality for non-concur users.

8. DataSnipper

For accountants seeking to elevate their productivity, DataSnipper is the tool you need. It seamlessly integrates with Excel, and increasing the efficiency of audit and finance teams. You can reduce repetitive, tedious tasks by up to 90 percent through automation and integrations.

The platform's ability to automatically extract, cross-reference, and validate the source document of any audit and finance procedure is particularly noteworthy.

With over 500,000 finance professionals across 85+ countries already benefiting from DataSnipper, it's clear that this tool offers tangible advantages tailored for the accounting world.

Pros:

- Ease of use.

- Accuracy with data and performing casting checks on financial statements.

Cons:

- Some features are not available on the basic plan and require higher-tier pricing to access.

- Limited customization options.

9. BotKeeper

With BotKeeper, you can bid adieu to your bookkeeping issues. It offers SOC2 Type 2 compliance and bank-grade security, ensuring your books are always safely managed. Every feature is tailored to be "accounting firm friendly," allowing you to work better and faster without sacrificing security.

Pros:

- Automation and accuracy reduce human errors.

- User-friendly platform.

- Responsive customer support.

Cons:

- Initial setup complexity.

- Cost concerns.

- Users have reported occasional technical issues.

10. SMACC

With easy invoicing, predefined reports, inventory tracking, financial statements, and data encryption, SMACC makes accounting a breeze. Accessible across devices and supporting global VAT needs, SMACC has the answers. Join 700k+ satisfied users and take your accounting from overwhelming to optimized with SMACC's comprehensive features designed just for accountants.

Pros:

- Offers top-notch security.

- You can create custom reports.

- User-friendly interface.

Cons:

- Limited online materials.

- Users have reported occasional technical issues.

11. MindBridge AI Auditor

MindBridge's AI Auditor is one of the most efficient accounting software. This cutting-edge tool doesn't just analyze transactions—it revolutionizes how audits are performed.

MindBridge employs advanced AI and machine learning to dig deep into massive amounts of ERP data, automatically flagging high-risk anomalies and potential fraud. Now auditors can focus their efforts on investigating discrepancies instead of performing endless manual reviews.

Built for the digital age, MindBridge delivers actionable visualizations and drill-down capabilities that uncover errors and risk areas quickly. Audits that once took months can now be completed in days.

Pros:

- Efficient analysis of large accounts.

- User-friendly and intuitive interface.

Cons:

- Potential learning curve.

12. AutoEntry

Forget tedious data entry. With AutoEntry's AI, you can automate your document processing. This intelligent tool goes beyond basic data capture—it analyzes and categorizes transactions from invoices, bills, statements, expenses, and more with unmatched accuracy.

AutoEntry's automation handles the heavy lifting so you can focus on strategic initiatives, not manual grunt work. Key details like subtotals, taxes, line item descriptions, and quantities are extracted instantly with validation checks to ensure accuracy.

By leveraging AI to eliminate friction from document processing, AutoEntry gives accounting professionals the gift of time. No more wasted hours spent on repetitive data tasks. Just efficient, reliable extraction so you can drive productivity and insights.

Pros:

- Ease of use.

- Syncs with your accounting software.

- Transactions can be assigned to the proper accounts, tax codes, departments, and tracking categories.

- Integrates seamlessly with Sage50 and Xero.

Cons:

- Processing time can be delayed sometimes.

- Users have reported poor customer service issues.

How to Train Employees on Using AI Tools for Accountants

As easy as an AI tool makes it for you to finish a task, it’s important to train your team to use it. Here are some tips on how to train employees on how to use AI tools for accountants:

1. Create your accountant training content. Start with an overview of your AI tools. What are they? How do they work? What are the benefits of using them? Use Scribe's AI process documentation tools to capture your process as you use the tool, and then auto-generate a step-by-step training guide with screenshots and annotated text.

2. Make training relevant to the employee's role. For example, if the employee is responsible for accounts payable, focus the training on how to use accounting tools to automate accounts payable processing.

3. Use a variety of training methods. Some employees may prefer to learn by reading documentation, while others may prefer to learn by watching videos or attending hands-on training sessions.

4. Provide opportunities for employees to practice what they have learned. Once employees have been trained on how to use AI tools, give them opportunities to practice using them in a real-world setting. This will help them to consolidate their learning and identify any areas for additional training.

5. Offer support. Once employees have been trained on how to use AI accounting tools, make sure to offer them support if they need it. This could include providing them with access to documentation, tutorials or a help desk.

6. Make training ongoing. As AI accounting tools continue to evolve, it is important to provide employees with ongoing training so that they can stay up-to-date on the latest features and best practices.

Accounting Tool FAQs

What Are the Advantages of Using AI in Accounting?

AI in accounting offers numerous advantages, including automation of mundane tasks, advanced error detection, real-time financial insights, and predictive analysis.

How Do I Choose the Right AI Tool for My Business?

- Assess your business needs

- Research various tools.

- Consider the features available on the most popular platforms.

- Choose one that aligns with your requirements and budget.

What are Some Tips for Getting Started With an AI Tool for Accounting?

- Start with proper training.

- Use online resources.

- Seek expert guidance.

- Ensure regular updates.

How Can AI Tools Help with Bookkeeping?

Bookkeeping automation tools can automate accounting data entry, categorize transactions, provide real-time updates, and ensure accuracy in bookkeeping.

How can Accountants use ChatGPT?

ChatGPT, an AI-powered language model, offers several ways for accountants to enhance their work processes.

- Use ChatGPT as a virtual assistant for quick access to information and calculations.

- Automate repetitive tasks such as generating financial reports and performing data analysis.

- ChatGPT can help with tax preparation and save time for accountants.

- ChatGPT can provide insights and suggestions based on its knowledge base.

Note: OpenAI has published a warning that "ChatGPT sometimes writes plausible-sounding but incorrect or nonsensical answers." Any information output by ChatGPT should be verified.

The Future of AI in Accounting

As the technology continues advancing, AI will transform daily accounting tasks and unlock new levels of productivity and strategic insights.

- AI automation will handle repetitive, high-volume tasks such as bank reconciliations, invoice processing and expense report creation.

- Intelligent process automation will expand, integrating AI capabilities into accounting platforms and systems.

- AI will enhance data analytics, identifying hidden patterns and trends in large datasets. This will enable more accurate forecasting and predictive modeling for cash flow and tax planning.

- Real-time performance tracking and reporting will be generated by AI systems.

- AI will improve anomaly detection in auditing, revolutionizing sample testing and forensic accounting.

- Pattern recognition will pinpoint suspicious transactions and errors for further investigation.

- AI auditing assistants will work alongside human teams to boost auditing productivity.

- AI will complement human skills, allowing accountants to operate at peak strategic capacity and drive business performance and growth.

Wrapping Up

Want to see how AI tools for accountants can help you improve your accounting practice? Scribe simplifies the process of generating accounting documentation. Empower your accounting team to produce accurate and comprehensive documentation, so you can focus on what you do best: serving your clients. Try it out for free!