Introduction

Since accounting primarily deals with the incoming and outgoing flows of funds, managing accounting documents is considered a very delicate function in any corporation.

This is why accountants require accounting document management software to complete these jobs efficiently. It makes the work clearer and more concise without looking at multiple places to find what you want.

If you handle accounting for a small business and these problems sound familiar, it's time to invest in accounting document management software. Our article evaluates 7 document management tools to help you find the right one for your business.

TL;DR: Accounting document management software

What is accounting document management software?

Accounting document management software (ADMS) is a type of software that helps accounting firms store, organize, and manage documents. ADMS can help firms improve their efficiency, security and compliance.

Depending on the software, it can help save time, strengthen data security, assure regulatory compliance, and improve communication.

Accounting document management software can be used to manage a variety of accounting documents, such as:

- Client files: contracts, invoices and tax returns.

- Financial records: General ledgers, accounts receivable ledgers and accounts payable ledgers.

- Audit files: Audit files and supporting documentation.

- Legal documents: Employment contracts, non-disclosure agreements and shareholder agreements.

Top accounting document management software for 2025

Choosing the right tools for accountants can prove to be a difficult task. Each accounting document management software application has its advantages and disadvantages. Read on to see which tool is appropriate for your business.

1. Canopy

Canopy is a cloud-based practice management software suite for accounting and tax firms. It includes a variety of modules, including document management, time and billing, a client portal, and more.

Key features:

- Document storage.

- Version control.

- Workflow automation.

- Collaboration tools.

- Security features.

- Integrations with accounting software.

Benefits: Helps accounting firms to improve their efficiency, security and compliance.

Pros:

- Unlimited document storage.

- Client portal for easy file sharing.

- Version control.

- Workflow automation.

- E-signatures.

- Time tracking features for task management, expense tracking and invoice generation.

Cons:

- Canopy's customization is limited, so you'll have to adapt their workflows to fit the software.

- Setting up and configuring Canopy's ADMS can be challenging, especially if you have complex workflows.

2. TaxDome

TaxDome is a cloud-based document management software for accounting firms.

Key features:

- Document storage.

- Version control.

- Client portals.

- E-signatures.

- Integrations with accounting software.

Benefits: Helps accounting firms to improve their client communication and collaboration.

Pros:

- Document storage and version control.

- TaxDome allows firms to create secure client portals for clients to access their documents.

- Integrates with e-signature providers.

- Automates tasks like document routing and approval, saving time and improving efficiency.

- TaxDome integrates with popular accounting software like QuickBooks Online and Xero.

Cons:

- Some users have reported that TaxDome's customer support can be slow and unresponsive.

- TaxDome is more expensive than some other ADMS solutions, which can be a barrier for firms on a tight budget.

3. iManage

iManage is a cloud-based document and email management platform used by accounting firms, law firms and other professional services firms.

Key features:

- Document storage.

- Version control.

- Workflow automation.

- Collaboration tools.

- eDiscovery.

- Security tools.

Benefits: Helps accounting firms to comply with industry regulations and manage complex workflows.

Pros:

- Supports a large number of users and documents, and it can be customized to meet your specific needs.

- iManage offers a variety of security features to protect your data, including encryption, role-based access control, and audit trails.

Cons:

- iManage is a relatively expensive solution that not be affordable for small businesses or businesses on a tight budget.

- Users report a learning curve, and it may take some time for new users to become familiar with the software.

4. Onvio Firm Management

Onvio Firm Management by Thomson Reuters is a cloud-based accounting software for accounting firms. While it offers various features beyond document management, it excels in managing financial documents specifically designed for accounting firms.

Key features:

- Centralized document storage.

- Automated workflows.

- Version control.

- Time and billing.

- Client portals.

- Integrations with accounting software like QuickBooks and Thomson Reuters CS Professional Suite.

Benefits: Helps accounting firms to manage all aspects of their practice from one place.

Pros:

- Client collaboration: Share documents securely with clients through a client portal, facilitating collaboration and streamlining document exchange.

- Optical Character Recognition (OCR): Extract data from scanned documents automatically, eliminating manual data entry and reducing errors.

- Track changes made to documents and maintain a complete audit trail for compliance purposes.

- Compliance with industry regulations: Provides features and security measures to comply with data privacy regulations like HIPAA and SOC 2.

Cons:

- Can be costly compared to dedicated ADMS solutions, especially for smaller firms.

- Limited document editing: While it offers basic document viewing and annotation, its editing capabilities are less robust than dedicated document management systems.

- Learning curve: Compared to simpler ADMS options, Onvio Firm Management has a steeper learning curve due to its wider range of features.

5. SmartVault

SmartVault is a cloud-based document management software popular for accounting firms and other businesses. While not a dedicated ADMS, SmartVault can be a good option for managing some accounting documents and collaborating on financial information.

Key features:

- Document storage.

- Version control.

- Workflow automation.

- Collaboration tools.

- Client portals.

- E-signatures.

- Security features.

- Integrations with accounting software.

Benefits: Helps accounting firms improve client communication and streamline workflows.

Pros:

- Easy to use and navigate, even for users with no prior document management experience.

- Scalable to meet the needs of businesses of all sizes.

- Offers a variety of security features to protect your data, including encryption, role-based access control and audit trails.

- Integrates with a variety of other software applications, including accounting software, CRM software, and e-signature software.

Cons:

- Not specifically designed for accounting: Lacks some features specific to accounting document management, such as automated tax document retrieval or expense tracking.

- Limited automation: While it offers some automated workflows, they are less comprehensive than dedicated ADMS solutions.

- Advanced features like e-signatures and advanced reporting can be expensive.

6. Zoho Books

Zoho Books is a complete accounting solution for organizations of all sizes that manage money. While not considered an ADMS, it offers comprehensive accounting features, including invoicing, expense management, bill pay, and financial reporting.

Key features:

- Integrated document management.

- Automated document capture.

- Document categorization and search.

- Version control and audit trails.

- Security and permissions.

- Mobile apps for iOS and Android devices so that users can manage finances on the go.

Benefits: A good option for small businesses or freelancers who need basic document management capabilities alongside their accounting functions.

Pros:

- User-friendly interface that makes it easy to get started.

- Affordable pricing: Zoho Books offers a variety of pricing plans to meet the needs of businesses of all sizes.

- Cloud-based: Zoho Books is a cloud-based solution, so users can access their data anywhere with an internet connection.

- Good customer support: Zoho Books offers good customer support options, including phone, email, and live chat.

Cons:

- Limited features: Zoho Books does not offer all the features available in other accounting software solutions.

- Some of the more advanced features in Zoho Books are only available in the higher-priced plans.

7. Bonus tool: Scribe

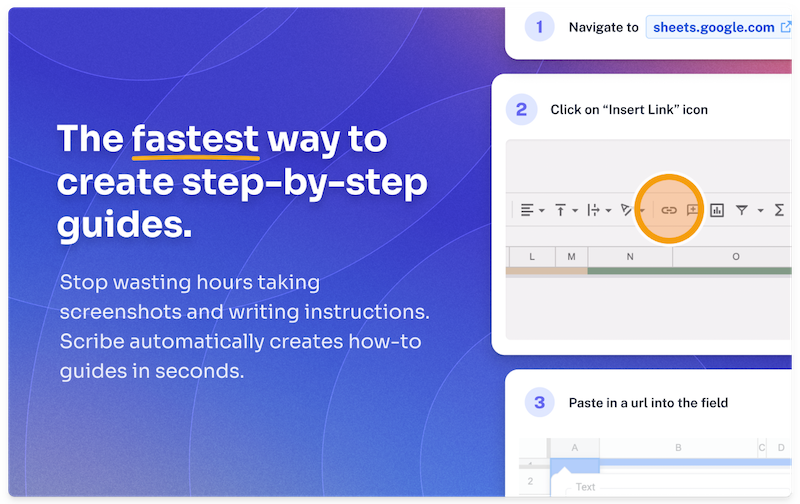

While not an ADMS, Scribe is an AI-powered tool that simplifies the accounting documentation, making it easy to share with clients or your team. From financial procedures to internal controls and reporting guidelines, Scribe helps quickly create professional, standardized documents.

Key highlights:

- AI-powered manual generator: Scribe leverages advanced AI to streamline the creation of SOPs for accounting, accounting manuals, how-to guides, and more, enabling your team to produce precise, comprehensive documentation easily.

- Consistency and reliability: By maintaining standardized formats, terminology and structures, Scribe enhances the quality and reliability of your manuals, minimizing errors and inconsistencies.

- Efficient collaboration and version control: Scribe facilitates teamwork on the same manual, ensuring efficient version control, streamlined document management and seamless collaboration.

Benefits: Scribe's AI technology makes it easy to develop process documentation, such as tool overviews, onboarding instructions, and help centers. Simply choose the Scribes you want to include in your process document and ask the AI to write documentation with a simple prompt.

Scribe user Sarah at Ignite Spot Accounting shares how she uses Scribe to document processes for Quickbooks and payroll tools for hundreds of clients.

Pros:

- Scribe auto-generates step-by-step instructions automatically by capturing your screen as you work. Scribe turns your mouse clicks and keystrokes into textual instructions with annotated screenshots.

- Easily edit and update your documentation in seconds — and with universal updates, the changes will be made wherever your documentation is stored.

- Use Scribe's ChatGPT tools to customize your documentation — add details relevant to your accounting practices, titles, descriptions, additional context, and more.

- Ensure you stay compliant by automatically redacting employee or customer data from screenshots (Pro users).

- Add your company's branding to create professional client-facing digital documents.

- Scribes can be shared with your clients or teams or embedded in a CMS, LMS, or knowledge management platform.

Cons:

- While Scribe's free plan offers rich functionality and quick customization, branding is only available for Pro plan.

- Screenshot annotations and redactions are also only available for Pro subscribers.

Accounting document management software features

Accounting document management software typically offers the following features:

- Document storage: ADMS provides a secure central location for storing all of a firm's documents. This makes it easy for staff to find the files they need and for clients to access their files securely.

- Document organization: ADMS provides tools for organizing documents into folders and categories. This helps firms keep their documents organized, making it easier to find the files they need when they need them.

- Document version control: ADMS tracks document changes and saves all document versions. This helps firms protect their data and ensure they always have access to the latest version of a document.

- Workflow automation: ADMS can automate tasks such as document routing and approval. This can help firms to save time and improve efficiency.

- Collaboration tools: ADMS provides tools for collaborating on documents with other users. This can be helpful for complex projects or reviewing documents with clients.

- Security features: ADMS includes security features to protect documents from unauthorized access. This includes features like password protection, role-based access control, and encryption.

Benefits of accounting document management software

A client's financial data is the core of any company's activities. Therefore, it becomes essential for businesses to invest in document management for accounting, together with all the associated tools and procedures.

So, why should an organization focus on finding document management software for accounting?

1. Lowers the costs of document maintenance

Document management for your accounting firm reduces business paperwork expenditures. Businesses and customers can lessen their reliance on paper by making documents, transactions, and records available online.

2. Allows documentation to be more accessible

Document scanning allows you to access your files whenever you need them without waiting for long periods.

When documents are saved in the cloud, employees no longer need to be present on-site to access the required data. They can log in remotely and use a simple keyword search to find documents.

Systems that enable remote work can give you an advantage in the very competitive quest for accounting employees.

3. Reduces human error

The cost of making a mistake when dealing with financial data is much higher than you can expect. In 2017, Uber was one of the victims of such an error, which cost them about $500 million.

Accounting software allows you to log transactions and data, rapidly produce and send invoices, and calculate business balances. Because these operations will be automated, there is little likelihood of errors occurring as long as you enter the correct data.

4. Boosts productivity & efficiency

A report from data analysis firm Elastic teamed up with Wakefield Research, stated, “More than 4 in 5 (81 percent) office pros can’t find an important document “when a boss or client has put them on the hot seat. Of those, nearly one in three office pros (31 percent) frequently struggle to find necessary documents during a tense moment at work.”

Moreover, the act of manually handling accounting tasks can add up time as well. Thus, having an automated accounting document management process saves a typical worker hours and hours.

5. Improves document security

A platform for accounting document management software that balances easily accessible information with securely kept client records is required.

By implementing a comprehensive security suite, businesses may dramatically reduce the chance of data breaches, whether from internal or external bad actors.

Automating routine communication tasks and workflows like reviews and approvals will improve staff productivity and efficiency. Most significantly, staff time will be freed up to work on more crucial tasks.

Choosing accounting document management software

Choosing the best accounting document management software for your company can be challenging. Every application has a unique collection of features, and most have numerous pricing options that differ in capability, number of users, and other factors. Check out customer reviews and weigh the pros and cons when looking for the right software.

Fortunately, accounting document management software is available to assist you in modernizing your firm, increasing accuracy, and creating a uniform and organized approach to handling essential information. Ready to automate your accounting documentation process? Sign up for Scribe for free today!